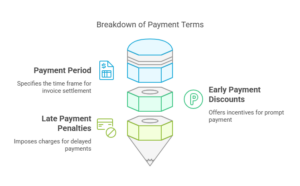

Payment terms are the conditions under which a seller will complete a sale, specifying the period allowed for the buyer to pay off the amount due, any discounts available for early payment, and any penalties for late payment. These terms are a crucial part of financial agreements and contracts between businesses and their customers.

Defining the Payment Period

The payment period is one of the most important aspects of payment terms. It specifies how long a buyer has to pay an invoice from the date of issuance. Common payment periods include “Net 30,” “Net 60,” or “Net 90,” which mean payment is due within 30, 60, or 90 days, respectively. These terms help businesses manage their cash flow by outlining clear expectations for when payments should be received. Clear payment periods also aid in maintaining good business relationships by preventing misunderstandings and disputes over payment timelines.

Discounts for Early Payment

To incentivize prompt payment, sellers often offer discounts for early payment. For instance, a term like “2/10, Net 30” means the buyer can take a 2% discount if the invoice is paid within 10 days; otherwise, the full amount is due within 30 days. Early payment discounts benefit both parties: the seller receives funds more quickly, improving cash flow, while the buyer saves money on the purchase. These discounts can also encourage a culture of prompt payment and enhance trust between business partners.

Penalties for Late Payment

Penalties for late payment are another essential component of payment terms, designed to discourage delayed payments and compensate the seller for the inconvenience. These penalties can take the form of interest charges, late fees, or other financial penalties. For example, a term might state that a 1.5% interest charge will be applied to overdue invoices each month. Clear late payment penalties help ensure that buyers adhere to agreed-upon payment schedules, thereby protecting the seller’s financial stability.

In summary, payment terms are a vital aspect of business transactions, providing clarity on payment periods, offering incentives for early payment, and outlining penalties for late payments to ensure smooth and reliable financial operations.