An EMV chip is a small microprocessor embedded in credit and debit cards designed to enhance security and reduce fraud during card-present transactions. Named after its original developers—Europay, MasterCard, and Visa—EMV technology has become the global standard for secure payment cards.

Enhanced Security Features

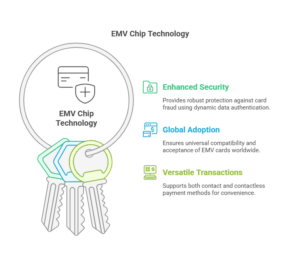

The primary advantage of EMV chips is the enhanced security they provide compared to traditional magnetic stripe cards. EMV chips use dynamic data authentication (DDA) to generate a unique transaction code for each purchase, making it extremely difficult for fraudsters to clone or duplicate the card. Unlike magnetic stripes, which store static information that can be easily copied, EMV chips encrypt transaction data, ensuring that sensitive information is securely transmitted and reducing the risk of unauthorized access and counterfeit fraud.

Global Adoption and Compatibility

EMV technology has seen widespread adoption globally due to its robust security features. Most modern payment terminals and ATMs are equipped to read EMV chip cards, making them compatible across various countries and regions. This universal acceptance is particularly beneficial for travelers, as it ensures that their cards can be used securely worldwide. The shift towards EMV technology has significantly reduced card-present fraud, prompting many countries to mandate its adoption for both issuers and merchants.

Point of Sale (POS) Usage and Contactless Transactions

EMV chips support both contact and contactless transactions, offering flexibility and convenience at the point of sale (POS). For contact transactions, the card is inserted into a chip-enabled terminal, where it remains throughout the transaction process. This method provides a secure environment for processing payments. Contactless transactions, often referred to as “tap-and-go” or “wave” payments, involve tapping or waving the card near a compatible reader. These transactions use Near Field Communication (NFC) technology and are typically faster while maintaining the same high level of security, making them ideal for quick, everyday purchases. The use of EMV chips at POS terminals ensures that consumers and merchants benefit from the highest levels of transaction security and efficiency.

In summary, EMV chips provide a secure, globally accepted, and versatile solution for credit and debit card transactions, significantly enhancing protection against fraud while offering the convenience of both contact and contactless payment options at point of sale terminals.