Payments

Get the latest payment updates and learn about new integrations and features in your region.

Deferred Online

We are introducing a new feature, enabling operators to accept payments even when connectivity is limited or unstable (e.g. on trains and buses), and facilitating faster checkout in high-traffic environments (e.g. parking and public restrooms). Deferred Online has two modes, Always Deferred Mode and Deferred as Backup Mode.

| Always Deferred Mode

Nayax enables operators to offer faster checkout and avoid long queues, by allowing up to 60 taps per minute in heavy traffic environments, such as parking exits or public restrooms. A device that is set to Always Deferred will defer a pre-defined number of transactions, or send transactions after 10 minutes in idle mode. For example, where an operator sets the transaction count for a given machine to 50, cardholders paying at the device will receive immediate approval (unless the card is expired, or its number is not compliant), and transactions will be sent for authorization and settlement once the device has been in idle mode for 10 minutes, or after the 50th transaction, whichever happens first. This way, 50 checkouts can go through, with a shorter waiting time. The risk for declines can be managed by adjusting the maximum transaction count to the most suitable level.

| Deferred as Backup Mode

Nayax enables operators to accept payments in areas with unstable connectivity. Installations on trains, light rails or buses going through areas with limited cellular connectivity, can be configured with the deferred mode as backup. Where an online authorization is not possible, the device enters Deferred Online mode. The cardholder paying at the device receives immediate approval (unless the card is expired, or its number is not compliant), the transaction is then deferred and will be sent to the relevant server once the device reconnects. The device will remain in Always Deferred Online mode for the time defined (in minutes) by the operator in Nayax Core, or until a pre-defined maximum number of transactions is reached. The risk of declines can be managed by changing the maximum duration for which the machine may be in this mode, or adjusting the maximum transaction count to the most suitable level.

| Prerequisites

Deferred Online can be configured for single-vend MDB and Marshall machines, in pre-selection or pre-authorization mode. It applies to EMV Contactless/NFC Card transactions only. Extra Charges or Discounts may not be processed while the machine is in Deferred Online mode.

The feature can be activated upon request to Nayax Support and will be enabled after signing an addendum to the Nayax agreement.

Version support:

VPOS Touch: 4.0.23.6

Onyx: 4.0.23.6

| Configuration

- Prerequisites

- A legally-binding agreement covering Deferred Online mode must be signed with Nayax before activation.

- Relevant permissions must be granted by the Nayax support team.

- The operator must configure the relevant machines.

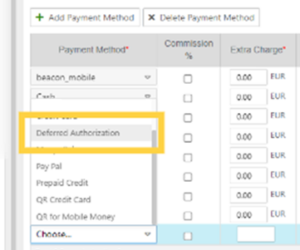

- In the Payment Tab of the Machines page, click Add Payment Method and select Deferred Authorization from the drop-down menu. On the Extra Charge field, enter 0. Then click Save.

- Under the Deferred Authorization Definition, choose one of the Deferred Authorization modes, and click Save.Deferred Authorization modes:

- Always Deferred: Activates Deferred Authorization for every EMV Contactless/NFC transaction.

- Deferred as Backup: Activates Deferred Authorization in the event of online transaction fails due to unstable connectivity.

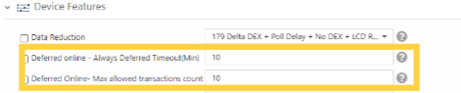

- In the General tab of the Machine Page, click Device Features and define the two attributes for Deferred Authorization:

- Always Deferred Timeout defines how many minutes the device will stay in the deferred online mode after failing to complete the transaction online. This attribute is relevant only if Deferred as Backup is selected under Deferred Authorization Definition. When the value configured is 0, the device will always try an online transaction first. Recommended Value: 10

- Max Allowed Transaction Count is the maximum number of transactions that can be deferred and held in the device at a given time. Recommended Value: 20

Extended Refund Period

Extended Refund Period

Enabled in Australia, Canada, Emirates, Israel, New Zealand, Turkey, USA

Nayax has extended the purchase refund period to 180 days, meaning that payments can be refunded to the cardholder account for up to 180 days from the date of the original transaction.

This new policy is enabled for billing providers that support Refund 2.0*. The number of days until the refund is made may vary, depending on local regulations and billing-provider policies.

Transaction refunds can be made by clicking on the arrow in the furthest-right column of the Dynamic Transaction Monitor (DTM). They are then displayed as a negative amount in a new line on the Dynamic Transaction Monitor.

* The following billing providers support Refund 2.0:

Heartland Nayax EMV, Heartland Direct EMV, Chase Direct, Chase – Facilitator, Ashrait, Ashrait – Direct, Ashrait Retail Tandem, Bank of Tahiti, Network International, WorldPay, Coriunder Ecomm, ipayafrica, ProvisionPay

Note: The 180 days will run from the date on which Refund 2.0 was originally enabled.