The Advantages of Mobile Payment Apps

Using your phone to make payments is becoming increasingly common as a payment method. When you install a mobile payment app on your phone you no longer need to carry cash or a credit card to buy something on a whim.

Across Europe, contactless payment is widespread and will continue to grow. However, this payment method still has a ways to go before it is commonplace in the USA. JP Morgan conducted a survey that found that only 16% of US consumers had completed a payment with a digital wallet transaction. But there is good news too: the research company Forrester reports that by 2021, mobile payments will triple in the USA, reaching up to $282 billion in annual sales.

Introducing mobile payment apps

Convenience and speed

The most well-known mobile payment apps such as Apple Pay, Google Pay, and Samsung Pay use near-field communication (NFC) technology. These are among the 10+ different mobile payment apps Nayax’s VPOS Touch accept.

With these apps, consumers link their credit and debit cards to their app of choice. When it comes time to pay, they hold up their phone to the NFC terminal, which makes an instant payment. This is a lot faster than payment via a traditional credit card, which can take 15-20 seconds to process.

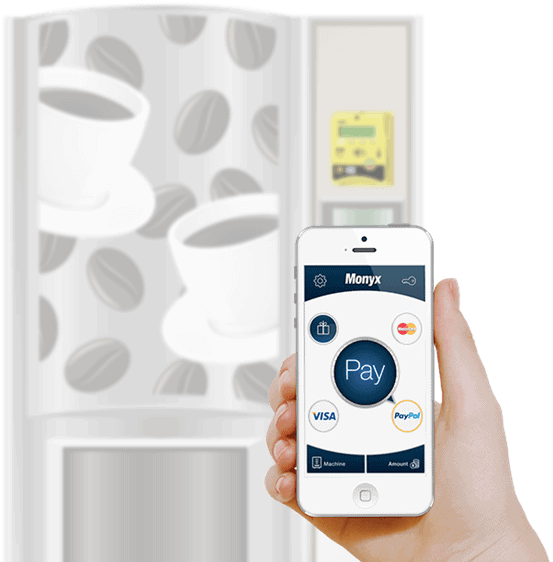

Nayax has its own mobile app, Monyx Wallet, which also helps consumers speed up the payment process at vending machines. A user can choose Monyx Wallet as their payment method, open the app, and enter the machine ID number on the app, or scan the QR code. Then the consumer presses pay and selects the product.

The advantage of Monyx Wallet is that it also has marketing opportunities for the operator. These include branding and consumer engagement tools, allowing operators to communicate with their consumers directly.

Ask us about our cashless solutions

Added security measures

Mobile payments also provide increased security for merchants and consumers. Apple devices have fingerprint scanners, and many Android devices also have this capability.

More importantly, digital wallet users do not expose their cards to skimmers, which can steal credit card information. This sort of information is stored in their phones instead.

Introducing QR Codes

Alipay and WeChat Pay are the two main digital wallets in China. They make use of QR codes (Quick Response), where consumers scan these codes at the point of sale, and this links to the consumer’s bank account. Like NFC payments, QR codes also complete transactions much faster than credit cards.

Even if you’re not an operator in China, there are two reasons to equip your unattended machine with dynamic QR scanning capabilities. The first is that Alipay, which already has a presence in Thailand, India, Hong Kong and the Philippines, is looking to branch out further in Asia, the US and Europe. The second is Chinese travelers, who are accustomed to paying via QR codes, now expect and ask for their preferred mobile payment method when abroad.

Mobile payment apps take advantage of NFC and QR codes, which offer consumers the benefit of speed and security. Accepting QR code payments can give your machine an added advantage over your competitors. Make sure your unattended machine have these capabilities with Nayax’s cashless payment solutions so that you too can profit from the cashless revolution that is taking over the payment world.