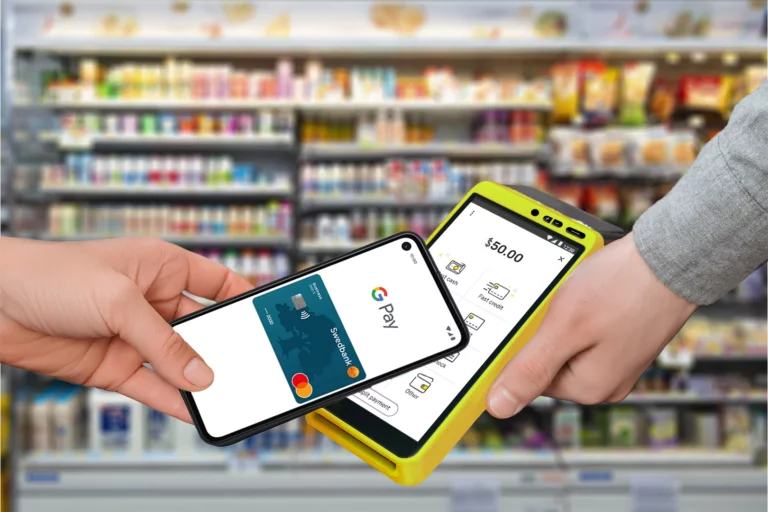

The way money changes hands has evolved rapidly over the last few decades. Instead of grimy coins and faded notes, you can now swipe, dip, tap, or simply wave your card, phone, and even your watch at a payment terminal. Consumers find the convenience and speed of these payment platforms so appealing, cashless transactions across the globe have increased by roughly 60% since 2016. So how can retailers leverage buyers’ spending habits and payment preferences in a cashless society?

The Rise of Cashless Payments

Cashless payment has enamored consumers since 1950 when the first Diners Club card was introduced by businessman Frank McNamara. While dining at a New York City restaurant, McNamara realized that he had forgotten his wallet back at home. Luckily, his wife was carrying enough cash to cover the tab then, but McNamara wanted to ensure he would never be embarrassed again. This led to the birth of the world’s first multipurpose charge card.

More recently, the COVID-19 pandemic that became a catalyst for an even more prevalent shift to contactless payments and mobile wallets. Federal Reserve data states that cash’s share of all payments in the US decreased by seven percentage points in 2020. But it’s important to note that while consumers latched on to cashless payment solutions because of hygiene and sanitary restrictions, the convenience, security, and speed offered by digital platforms have made these solutions sticky.

Consumers Want Cashless: What Will the World Look Like in 5 Years?

A cashless world could become a reality within the next five years. Even today, a new Pew Research Center survey found that 41% of Americans don’t use cash to purchase anything in a typical week. In 2018, this figure stood at 29%, while in 2015, it was only 24%. What is particularly fascinating is that the adoption of non-cash payment platforms is growing across income groups and 42% of Americans, regardless of their socioeconomic status, don’t worry much about whether or not they have cash with them since there are other ways to pay for things.

In Europe, meanwhile, contactless has already become a common payment method. For instance, only 15 percent of payments involve cash in Sweden, which is on its way to becoming the world’s first cashless country. Similar trends are prevalent across the UK where cash accounted for 45 percent of all payments in 2015, but five years later, it was used in only 17 percent of transactions. Even small countries like Somaliland have a thriving mobile payment ecosystem, while several fast-growing economies including India and China have embraced QR codes.

Perhaps this is why a PwC analysis suggests that global cashless payment volumes will increase by more than 80 percent between 2020 and 2025. According to PwC, cashless transaction volume is set to increase from about 1 trillion transactions to almost 1.9 trillion in the next three years, and then almost triple by 2030.

Future-Proof Your Business with Cashless Payment Acceptance

For businesses and retailers, it makes all the more sense to adopt integrated payment solutions because going cashless encourages consumers to spend more than they otherwise would. In behavioral economics, the phenomenon of people finding it easier to part with intangible money is known as the “cashless effect“. Interestingly, it has been observed that the cashless effect occurs not only in big-ticket purchases but even for payments as small as $1, and for simple day-to-day activities like doing laundry. It’s no wonder then that while the average value of a cash transaction in the United States is $22, an average noncash transaction is $112.

Being offered convenient payment options is also one of the most important factors customers consider while making a purchase (41%), second only to customer service (60%). And let’s not forget that accepting card payments makes even small businesses appear more professional, builds credibility, and makes prospective customers more confident about their purchases.

Nayax and Cashless Payment Solutions

There are several types of cashless payments such as swipe cards, EMV-enabled chip cards, QR codes, mobile wallets, and more. A modern payment suite such as Nayax’s will allow your business to accept and process all forms of cashless payments in 40 currencies. Nayax’s award-winning, all-in-one cashless payment solutions are trusted by more than 38,000 businesses in both attended and unattended retail.

Solutions for Attended Retail: From sleek, easy-to-use electronic cash registers to mobile Point of Sale (POS) devices that allow you to complete a transaction anywhere, Nayax offers cashless payment solutions for businesses of all sizes. Run a multi-branch business? Our universal retail solution will integrate directly with your ERP. Making house calls or setting up a stall at a fair? Use the portable Nova 55 to bill and send customers branded receipts via SMS or email.

Solutions for Unattended Retail: Nayax offers several plug-and-play cashless payment devices and self-checkout solutions for vending machines, interactive kiosks, micro markets, and other unattended retail businesses. While Onyx is compact enough to fit on any small machine, VPOS Touch’s high-resolution color touchscreen makes it ideal to run marketing campaigns.

But regardless of the solution you choose, Nayax’s payment gateways will help you to achieve double-digit growth in your revenue because they give you the ability to offer loyalty programs that increase consumer interaction, reduce your cash handling costs significantly, and allow for complete transparency into all transactions as well as inventory status.

Conclusion

In an increasingly cashless world, businesses that don’t accept cashless and contactless payment options run the very real risk of alienating customers and losing out on growth. In addition to giving the business a competitive edge, digital payment solutions can increase revenue opportunities with impulse spending, strategic pricing, and easy-to-manage loyalty programs. Want to offer your customers a more seamless and rewarding buying experience? Check out our integrated cashless payment solutions and contact us to learn more.