Do you own a small business? You’ve probably noticed as both a business owner and a customer that cashless payments are the trend of the future. Small businesses that are looking to scale and grow have to adopt digital and cashless payments to keep up with the competition and keep customers satisfied.

But first, let’s take a step back. Once upon a time, processing payments was a difficult task. Even getting credit card sales going for a small business was a time consuming and potentially arduous process, one that kept small businesses from scaling. After all, if you don’t give your customers the chance to pay in a convenient way, they simply won’t come back.

Luckily, those days are over. Small businesses looking to scale have numerous opportunities to adopt cashless strategies including bringing in digital card readers and equipping their POS with the best technology available on the market today.

Are you looking to take your small business to the next level? We’ve got you covered with our top tips for scaling and how to go cashless today.

Top tips to scale your business

You know your business has the potential to be something huge. But, maybe you simply don’t know how to scale. Before thinking about going cashless and other various payment schemes, it’s critical to adopt a few initial steps to scale your business.

Plan, plan, plan

You don’t run a marathon without training before. And you don’t scale a business before training your business, AKA making a plan.

The first part of planning is to take a step back and evaluate your current situation. Where are you? What is your growth potential? Where in your business do you think you should focus on scaling?

In some cases, this part of growth should be done with a professional. Perhaps a business consultant or strategist, in other cases a financial advisor, product marketer, hiring manager, and so on. The goal is to bring in the right people that can help you find the right direction for your plan. It’s not enough to want to grow, you need to know how you’ll scale and in which direction.

Secure funding

Scaling costs money, there’s no getting around it. In order to scale, you’ll need to make sure you have enough cash in place. There are various ways to bring this money in, including taking out loans, crowdfunding, creating new revenue streams, or bringing in investors.

Whichever method you decide to use, make sure you address how much money you’ll need in the planning phase. This will help you map out the financials of scaling and reduce stress in the long term by making sure you have the proper funds available to finance your plans.

Adopt the necessary technology

While putting up the cash to bring in the right technology may seem daunting at first, in the long run, you’ll save by scaling with the proper technology in place.

Think of it like this — Do you want people doing things that computers and algorithms can do on their own? For example, let’s take a look at automation practices. You can set up various processes in your business to be automated, which is an essential part of scaling. No one has the time or the manpower to create receipts for each payment, to send follow-up emails to leads, or to assign different tasks to different workers.

At the same time, take the opportunity to run through the different types of software you’re already using in your business and see if they are compatible with your scaling goals. If not, switch them out for more appropriate tools.

Delegate and hire

You can’t do everything yourself, even if you really believe you can. Whether you’re a solopreneur or a small business owner with a small staff, there’s always room for bringing in new talent before scaling up.

This looks different for different businesses. In some cases, it makes sense to hire new employees, while in others, it might make more sense to bring in freelancers to cover the load while you’re growing. Think about the added value of having someone in-house or external when making this decision. Don’t forget that employees will most likely be more dedicated to your company and your team, which may make a difference in massive scaling efforts.

The financial side of things — How do small businesses go cashless?

Companies are embracing cashless payments today more than ever before. The exciting news is that bringing cashless payments into your business opens up new doors and opportunities with customers that you may not have been able to work with in the past.

There are various ways to go cashless – from more traditional methods to new digital payments that are changing the game for both businesses and customers.

So, what are the different ways to go cashless and what are the benefits and drawbacks of each method?

Credit card readers

Credit cards are a common form of cashless payments that go back many years. We all know the drill, we enter a store (or an online store for that matter) or restaurant and hand the credit card over to the salesperson to continue the transaction.

With over 80% of consumers preferring to pay with card over cash, any business looking to scale, must adopt a system to accept credit card payments. This used to be the default method for many looking to give options other than cash and check (remember those?) with simple credit card swiper machines being the norm (once upon a time they weren’t even digital!).

The issue is that accepting credit cards is just one piece of the bigger puzzle: Will you only accept credit cards? What about other digital payments? How will you manage the different payment options and how will you decide which are the most appropriate for your style of business? In the post COVID-19 world, small businesses must also take into consideration the safety of using credit cards (multiple people touching the cards and the machinery) and what will cause their customers to feel the most comfortable at the POS.

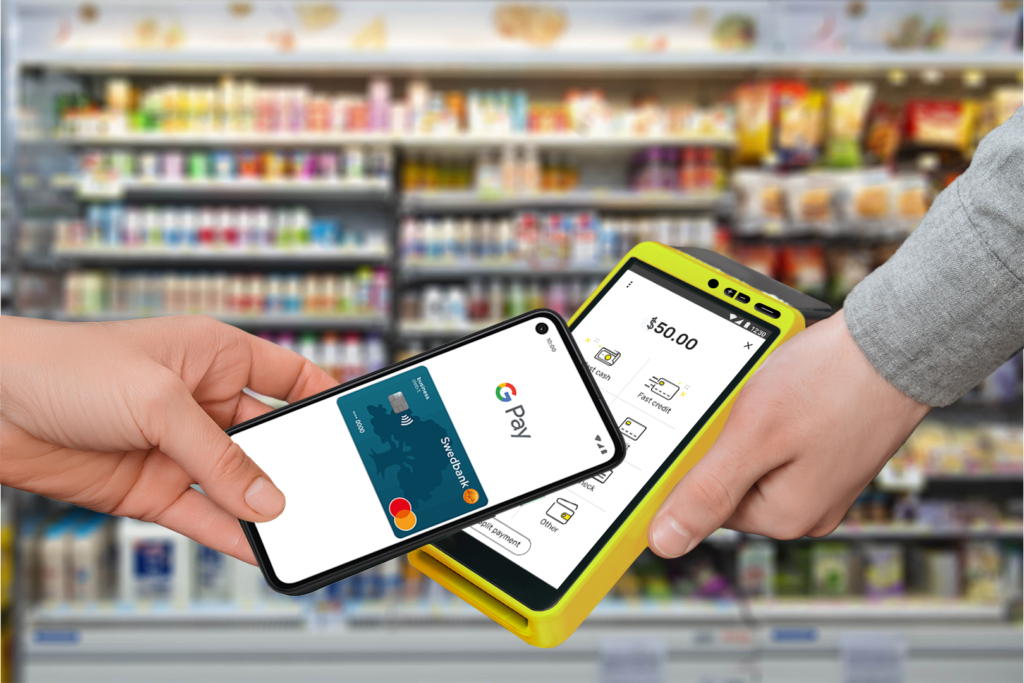

One of these options is contactless payments, where the buyer uses NFC technology in their credit card to place the card near a reader without having to interact with another person. However, in today’s age, we’ve already graduated to new forms of payment that don’t even require showing your card.

Cardless payments

Once upon a time, it may have seemed like a distant dream to be able to pay with your credit card without taking it out of your wallet.

However, those days have arrived. With the introduction of Apple Pay, Google Pay, and other digital payment schemes, customers are given the chance to pay without even showing their credit card. Today, many also prefer this method as it can be safer as there is no contact involved. In fact, 51% of Americans reported that they are using a form of contactless payment when available. It’s convenient, fun, and safer in certain cases, although there is a downside for businesses — it can be more expensive. Businesses that are looking to scale must keep this information in mind, as customers are looking for convenience when shopping, and therefore cashless and contactless digital payments are an important solution for any small business.

Payment platforms

The competition is stiff, and there is a wide range of applications, payment platforms, and technologies that give small businesses the chance to embrace technology and get onboard with up-and-coming payment trends worldwide.

The benefit of these platforms is their ability to integrate with other systems within the business such as promotional tools, CRMs, accounting, campaigns, and more. This allows your point-of-sale (POS) to turn into a one-stop-shop for everything you need in your business.

Don’t forget about the mobile side of things. In today’s world, businesses aren’t always located in front of a computer and therefore, having the ability to deal with payments from mobile devices is a serious advantage.

When choosing a payment platform, it’s important to take into account the business size and anticipated size after scaling. Each type of business has its own setup and on one hand, you want a platform that addresses specific business needs, while on the other hand, you don’t want to change platforms a year or two after expanding. It’s important to take into account your trajectory to make sure the software you choose will meet your needs for the near future.

What kinds of businesses can benefit from scaling with cashless payments?

This answer is pretty simple — all businesses can benefit from the future of digital payments. With over $5 trillion in virtual card transactions expected by 2025, it’s clear that digital payments are the future of any small (or large) business.

Digital payments at retail POS

If you’re scaling your retail business, you’ll need a digital payment processor to speed up your work, meet your customers’ expectations, and make your life easier. When you’re able to eliminate cash and physical touch from any retail transaction, your work will be quicker, customers will be more satisfied, and you’ll have the ability to document every transaction with ease. This is also an advantage in certain situations such as returns, as retrieving information on each transaction will be simple and refunding will be as easy as clicking a button.

Cashless transactions on-the-go

Want to scale your business and take it on-the-go? Welcome to the age of technology where you can accept payments on an easy to use mobile device. If you’re a traveling business such as a food truck, an electrician or plumber, or a tutor, having the opportunity to accept digital payments on-the-go will give you a serious advantage over your competitors.

Cashless self-service businesses

Do you have a laundromat business? Vending machine? Car wash? There are certain cases where you don’t even need staff involved in the payment process. As self-checkouts become more popular and people are getting used to using credit card readers by themselves, digital payments can become a self-serve situation. By integrating the right cashless payment technology in your business, you’ll have the opportunity to scale rapidly, as you won’t have to put a focus on staff to assist with payments.

Cashless payments in the post-COVID-19 era

COVID-19 was a catalyst for digital transformations in almost every field. Payments were no different.

If in the past, cashless and contactless payments were just “nice to have”, COVID taught us that exchanging cash or even physical credit cards could put us in danger. Seemingly overnight, the ability to pay without having to touch or physically interact with another person became “must-haves” for any business wanting to keep their customers calm and confident in their purchase.

The need for contactless in-person payments was coupled with the dramatic increase in eCommerce shopping. Businesses that wanted to survive, let alone scale in the aftermath of the pandemic, had to get on board with cashless payments instantaneously.

Small businesses looking to scale post-COVID-19 must adopt cashless and contactless methods

Research by Juniper Research shows that transactions by virtual cards will more than triple in the next five years, up from approximately $1.6 trillion in 2020. With this massive increase and the overwhelming adoption of cashless payment methods, small businesses have no choice but to get on board if they want to scale and ultimately succeed.

Therefore, it’s no surprise that according to Visa, 82% of small business owners are making the move towards digital payments in the aftermath of the global pandemic. The Visa Back to Business Study showed that small businesses were racing to adopt new forms of contactless and cashless payments to meet safety standards and keep customers calm and feeling protected.

With 47% of shoppers saying that they will choose not to shop at stores that don’t offer contactless payments, business owners today simply do not have a choice but to adopt the latest technologies.

But, it doesn’t end at accepting payments. Small businesses looking to scale must adopt the entire digital payment process and boost technology in all sectors of business. This may include security and fraud management, mobile device payments, backend operations, and more.

Small businesses must adopt the right payment platform to scale

The ultimate goal of scaling is to increase your customer base and revenue. In order to bring in new clientele (and keep them coming), businesses must be able to make payment as easy as possible. Not only does the process need to be easy, the options must be wide enough to encompass the general population (or at least the target market).

This means accepting both contactless and contact payment options including debit and credit cards, mobile and NFC payments, prepaid cards, static and dynamic QR codes, and more.

With global digitization and digital transformation, the pace of consumer changes is staggering. A trend today may be gone next week, and certain payment options and methods may stick around for the near future. Businesses must choose a cashless payment option that will serve their business both today and in the future, allowing the business to grow over time while still having access to features and options that are most important to continue growth in the present.

All-in-one payment and management platforms

The market is swamped with various payment platforms. For small businesses in the process of expansion, choosing the correct one can be difficult.

Here are some things to consider when looking for the right platform for your business:

- Do you need access to payments on the go? Would you prefer the ability to accept cashless payments from your mobile device?

- What marketing efforts do you have? Do you want a platform that connects to your marketing strategy to help you run digital campaigns, discounts, and more? What about the ability to advertise on the payment device’s digital screen?

- Which payment methods do you want to accept?

- Do you have existing machinery or do you need a stand-alone solution?

- What does your POS look like? What type of payment platform will integrate best with your existing (or future) setup?

Answering these questions will help small businesses scale appropriately while choosing the best payment platform solution available for their needs.

Nayax: Making payments simple for small (and growing!) businesses

When it comes to adopting a payment solution for your growing business, Nayax provides the perfect platform for a wide variety of businesses.

With our all-in-one devices, you’ll be able to focus on your growth, while leaving the headache of digital payments to us. With Nayax, credit card and digital payments become simple and allow you to expand at a phenomenal rate.

You’ll be able to stay ahead of the digital payments curve with card readers that are based on the top technology available today. This will keep you ahead of the consumer pace and ahead of your competition.

Nayax also gives you a complete picture of what’s going on in your business, giving you the insights you need while scaling. You’ll also decrease costs by having valuable insights into your business, allowing you to take action on strategies and methods that can help you increase your revenue and your customer base.

Want to learn more about how Nayax can help your business grow to new heights? Click here to learn more.