For those in the unattended market, it’s been exciting to watch the increase of products and services sold through cashless vending machines, kiosk, and other unattended devices. But with worldwide events, the interest of consumers and operators has been dramatically impacted beyond the unattended world. There has been a noticeable global shift when it comes to how transactions are made, and those trends point towards a cashless future.

With the wave of COVID-19, the consumer preference for a cashless world has only been accelerated. But each country has embraced this wave of cashless transactions differently. With the infrastructures varying in individual countries and the willingness of their citizens to embrace a cashless society, no one country is alike. Some are leading the advances while others are met with more obstacles. After researching trend surveys and reports from countries across the world, we’re excited to share the data we’ve collected. In this article you’ll get to see how our world is shifting before our eyes, driven by the consumer demand for digital payments.

A bird’s eye view to the world’s response

Looking at the global statistics it’s clear that consumers are rethinking how transactions are made. Influenced by fears surrounding the transfer of cash due to COVID-19, consumers on a whole are more inclined to buy products and services where less contact is needed. In a survey conducted across the US, the UK and Australia, data gathered shows consumers are increasing their preference for digital and cashless payment acceptance. This desire for non-cash transactions is moving across sectors – not just retail and governmental – to include unattended market such as vending businesses, arcades, carwashes, and laundromats.

When it comes to digital payments, consumers have several options to choose from. Replacing standard payment methods are the leading virtual payment trends including biometric authentication, QR payment codes, mPOS (Mobile Point of Sale), smart speakers, contactless payments, and mobile digital wallets.

How exactly have these upcoming payment preferences been seen throughout the world? Mobile proximity payments using QR codes drove nearly half (48%) of POS (point of sale) payments in 2019. Instead of paying by inserting cash bills or even your credit card, nearly half of consumers preferred to pay contactless. With numbers like these, it’s no surprise that the rate of consumers preferring digital payments is rapidly rising.

Digital and mobile wallets are another consumer favorite emerging in the market. Featured throughout small businesses as well as in cashless vending machines, consumers can scan and pay with QR payment codes that link to e-wallet payment apps on their mobile devices. In 2019, e-wallets accounted for 22% of the global point of sale spend. That number continues to skyrocket in 2020, as digital and mobile wallets bypasses other payment options as the biggest trend in consumer payment preferences. E-wallets make shopping online convenient and easy. Market reports support consumer sentiment, as digital and mobile wallets lead eCommerce payment preferences with 42% of spending in 2019—up from 36% since 2018. With consumers showing a clear preference for the use of e-wallets, those in the unattended sector looking for additional ways to boost their kiosk sales or food sales in their vending machines can equip their machines with cashless payment capabilities and increase their machine’s revenue.

The preferred payment of choice

With an overwhelming percentage of consumers preferring cashless payments on the global scale, how are these numbers showing up in individual countries? According to a recent survey of adults throughout the US., UK. and Australia, 71% of consumers wanted unattended terminals to accept both bankcard and cash payments. Out of those surveyed, a considerable number showed a willingness to use wearable devices or digital wallets at these locations. In other parts of the world cashless trends were showing up as early as 2015. The Ministry of Economy, Trade, and Industry in South Korea reported more than 80% of the total amount of transactions made in that country were cashless. In that same year, China and Canada showed increasing rates of cashless transactions of 60% and 55%. Although the growing preference for digital payments continues to rise in the US, UK, and Australia, it’s interesting to note that there is a significant amount of countries that still prefer the use and exchange of cash. This only strengthens our claim that each country’s consumers are relating differently to cashless transactions. To help us understand which countries are driving the cashless trends, and the roadblocks preventing countries from moving toward a cashless society, let’s look at the major countries individually:

The American response to the cashless wave

It’s always been obvious; the love Americans show for their sacred credit cards. With that, the long-lived saying ‘Cash is King’ has quickly become increasingly redundant. Throughout the United States, the use of cash is dramatically declining, with the consumer transaction share dropping from 32% in 2015 to 26% in 2018. As cash transactions drop, the US is showing high receptivity to cashless payments. When given the choice, consumers show an increasing preference for cashless payments, using a variety of cards and apps. Mastercard reported a 40% jump in contactless payments during Q1/2020 due to Covid-19 in the United States alone. Included in these payment preferences were tap-to-pay and mobile pay.

Businesses that are using unattended, automated machines to provide consumers with a cashless alternative to paying with cash have seen a significant increase in sales. In America, the kiosk market alone was valued at $23.94 billion USD in 2019. And with the coronavirus encouraging cashless behavior, the unattended market’s unique solution has only strengthened. With a variety of technologies, restaurants, shops, malls, and even government services, can replace standard in-store and person-to-person transactions with vending and kiosk food sales. Consumers can function as their own cashiers, by handling purchases themselves. With solutions such as QR codes and smartphone transactions, consumers can leave their wallets at home and pay directly through their phones. The ways consumers can pay are endless, including Apple wallet, scan and pay PayPal QR codes, as well as gift cards, and traditional payments through credit and debit cards.

With cashless advancements continuing to emerge, self-services are rapidly growing across the region, one study shows. Most obvious is the demand within the retail, healthcare, entertainment, and travel markets. These businesses have needed to adapt, finding new ways to provide the same products and services without salespeople and customer service representatives. With vending machines and kiosks, these sectors can continue running while offering consumers an improved, convenient, and hygienic service.

Included in the support of non-cash transactions is the growing trend of mobile payments. Across the U.S. 51% of people are adopting mobile wallets for transactions, like Apple Pay tap-to-go payments, and e-wallets. As adoption rates continue to rise, it’s quite possible that the growing demand for self-service and cashless services and transactions will eventually become the new standard.

Canada’s acceptance of the digital era

Similar to their American neighbors, Canadians are also proving a willingness to move towards a cashless economy. Over the years there has been a noticeable decline in cash transactions, reports the Bank of Canada, both in the total number of transactions as well as their value.

When it comes to non-cash transactions, credit cards are an increasingly common payment method for Canadians. Surveys showed credit cards were the payment of choice for retail transactions by 39% and 56 % of the total value of goods and services purchased. With the highest penetrations of card-based payments in the world, more than 70% of personal purchases made in Canada are card-based. But this plastic consumer favorite isn’t the only rising digital payment. After a recent study by Visa, statistics show that 83% of Canadians have a smartphone, used for online shopping, in-store payments, and online banking. With a significant majority of the population using smartphones, it comes as no surprise that when looking at retail e-commerce, a full 25% of transactions are conducted through mobile devices. It’s understandable, that as the number of smartphone users rises, those same users would turn to their phones to manage their services and transactions.

With most brick-and-mortar shops having an online presence, cashless shopping has become the consumer choice due to its convenience. Visa reports that 7 out of 10 Canadian smartphone payment users cited convenience as the main driver for paying with their phone, versus traditional payment methods.

Over the years there has been a noticeable shift in Canada towards digital payments. Back in 2017, Canada was reported the number 1 most cashless country in the world. Nearly 73% of the total transaction volume in Canada at the end of 2019 was electronic, reported CTV news. But with the outbreak of Covid-19 that continues to spread and affect populations around the world, it’s obvious that consumers have shown an increased adoption and acceptance. According to Payments Canada data released in mid-May, 62% of Canadians reported using less cash and 42% had avoided shopping at places that don’t accept contactless payments. 61.3 million e-transfers took place in April and first-time users increased by 43% since mid-March.

Numbers don’t lie and it’s clear from these that Canadians are consistently opting for cashless transactions in place of cash. Nonetheless, cash isn’t completely redundant. The Bank of Canada still found cash to have its redeeming qualities. Regarded as easy to use and low in cost, Canadians still hold cash as the secure and nearly universally accepted payment option. When considering the payment options for small transactions like a cup of coffee or food sales of small baked goods, Canadians preferred to pay with cash. In fact, Canadians consistently choose cash as their payment choice specifically for the lower value transactions. “The lower the value, the more likely it is the buyer will choose cash,” reports the Bank of Canada.

In conjunction with the countrywide shift toward cashless transactions, even smaller sectors, such as the vending and unattended markets are finding ways to supply consumers with easier payment options. The vending sector in Canada, though small in size, hasn’t held them back. On the contrary, Canada has managed to make technological advances, above other countries in the race toward a cashless economy. Changes such as upgrading machines with integrative LCD screens and adding digital payment options have been made to vending machines, enhancing consumer convenience, and simplifying the ordering process.

Mexico’s slow and steady climb

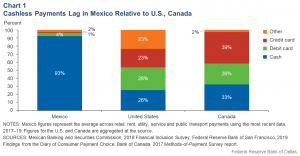

Moving down south, Mexico doesn’t share the same cashless growth trajectory as America and Canada. Data from a Dallas Fed report showed that Mexico substantially lags the U.S. and Canada in terms of debit, credit, and other cashless payment channels that include digital payment platforms, checks, and prepaid cards. Where cash payments in the U.S. and Canada remained low, Mexico’s rate of cash transactions totaled over 90%, clearly pointing to Mexico’s slow pace in the digital payment revolution.

Changing its citizens’ behavior is a challenging one, especially as customers and merchants in Mexico are accustomed to paying each other in cash. That’s not to say that the Mexican government hasn’t made efforts to push their country forward. Last year, the central bank launched its new digital payment platform – CoDi, short for Cobros Digitales (Digital Charges). The platform’s goal was to allow merchants and consumers to handle transactions leveraging the QR payment code technology to allow real-time consumer-to-consumer and consumer-to-business payments.

Since its release there has been a positive response with more than 2 million accounts created and more than 160 million pesos ($8.4 million) in total transactions, thus far. However, using this platform required users to have both a smartphone as well as an online banking account. With a strong initial response, there’s optimism for increased growth as the rate of smartphone users is on the rise with over 90% of Mexicans owning a smart device, up from 67 % in 2015.

In other studies, indications of a shift in the market are coming to light as steps are taken to move away from cash and physical cards. Throughout Mexico, those that have smartphones are beginning to use their devices for financial services. Plus, the government is making an effort by equipping more than 50% of their card terminals to facilitate cashless payments.

The effects of these changes are impacting Mexico’s economy, as reports indicate the e-commerce market credits a significant amount of transactions to mobile commerce. In the same, e-commerce data points to cash and digital wallets as the second-highest payment source.

When it comes to the retail markets, Mexico’s online presence is quickly growing, along with countries like Indonesia, India, and China. The development in the retail market can be heavily credited to these countries’ commitment and dedication to improving their government’s systems, such as improving online access, especially in mobile-first online communities.

Despite the efforts made by the Mexican government and the reported growth of cashless payment, Mexico is still seen as a cash-based country, reports Card Essentials. Despite what business owners may think, this information can allow for new growth opportunities. As the country accelerates its rate to move towards a cashless economy, small businesses like unattended operators can make similar advances, by offering mobile payment acceptance. This continuous effort from Mexico’s government and businesses alongside the technological advances in the cashless market and growing consumer adoption will move the country away from cash and into the digital future.

Payment preference in the United Kingdom

In the UK, citizens are showing similar reactions with a reported 30% increase in spending using contactless payments. Data collected in 2019 shows almost one in seven of the UK population chose to live a largely cashless life, with one in four of those aged 16 to 34. According to the financial institution, UK Finance, there are now 7.4 million people in the UK living an “almost cashless” lifestyle. With the continued decline of cash across the UK, in 2019 cash payments were recorded to be as low as 15%. During that time consumer habits have shifted toward card transactions, as retailers have expanded their acceptance of card payments along with the tremendous e-commerce growth. In 2019, non-cash payments accounted for more than half of all transactions.

During the past two years, the unattended sector has also witnessed similar consumer habits evolve across the U.K. According to reports, the use of bankcards at food and drink kiosks and vending machines in the U.K. has grown by a third. This is just one of several changes happening in the self-service market throughout the U.K. But that doesn’t come as a surprise since, in comparison to other markets, Europe is one of the most mature countries when it comes to adoption of self-service technologies. One contributing factor is the region’s strong and stable economy. For retailers, standard check-out stands are being replaced with unattended kiosks, allowing consumers to handle payment unassisted. With an array of technologies, consumers can use applications like QR code scanning, e-wallet apps, tap-n-go payments as well as standard card payments.

There has also been a growing attraction to kiosk sales and unattended vending machines as the benefits encourage sale and boost customer satisfaction. According to analysts, kiosk adoption has continued its expansion into new sectors, such as the tourism and entertainment sector, movie theaters, public transportation, and even amusement parks.

With all this change driving through the UK, the coronavirus only accelerated the country’s shift, affecting consumer payment behavior even more than before. Major retailers and service-based businesses, like the banking sector, have had to adapt to these new habits by offering cashless and contactless accessibility. In the days after the UK went into lockdown in March, consumer use of cash and ATMs declined by half, with all but essential shops shutting their doors.

The German response to dropping cash

Like America and Canada, the decline of cash has carried through to Germany, though the rate is far less dramatic. As German citizens are far less inclined to make the move to a cashless future, the use of cash is still relatively steady. McKinsey reports an annual decline of 1% – 2% in cash payments across all age groups, is very slowly leading to an increase in acceptance and usage of the card and digital payments. It’s true that throughout recent years online and mobile payment systems such as Apple Pay have made their way into the German economy, however, many German businesses owners – and consumers, too – regard cash as king.

Though the two statements may seem at odds with each other, it accurately depicts the country’s point of view when it comes to a cashless economy. On the one hand, cash is revered as a reliable and stable payment option. However, the country cannot deny the direction in which the world is headed. Therefore, there is still a rising acceptance of digital payments. A Concardis survey found that 52% of German consumers prefer to pay cashless. Compared to recent years, this is a dramatic increase from back in 2017 when digital payments were virtually unknown. Of those consumers who were willing to adapt to cashless payments, 15% of customers opted to use their debit cards. For SMEs, the cashless acceptance was reportedly 37%. Those who made the shift to digital transactions have accredited their faster payment processing at the POS to enable contactless payments.

In many countries, the coronavirus accelerated the public adoption of cashless payments and Germany has been no different. One found that by December 2019, German banks had equipped their users with contactless payments. A report put out by the BBC found that Covid-19 produced a significant change in German consumers. By late April, 43% of respondents said they had changed their payment behavior, compared to 25% at the start of the month. 68% of those who changed their behavior said they were now more likely to pay with a card. That same report revealed that due to the pandemic, 57% of Germans have shifted to using debit and credit cards, more than they did before and nearly half have considerably lowered their usage of cash. Comparing the volume of contactless transactions from before the pandemic to now, 35% of all debit card payments were cashless in December 2019, but that amount increased to more than half by late March 2020. Without a clear end to this pandemic insight, the number of consumers using contactless payments is only expected to increase.

Cashless payments hit Australia

The way consumers pay may vary but Australia is also showing a dramatic rise in cashless payments. When surveying the Australian public, 55% of consumers were comfortable with the idea of a completely cashless society. Such a high sentiment can possibly be attributed to the increasing adoption of smartphones and tablets. With the number of devices in Australian hands, consumers are inclined to handle sales and services like online shopping straight from their phones.

According to research, mobile payments have also been a driving force affecting the market’s growth over the years. Since the start of the outbreak of COVID-19, Australia saw an increase in payments via mobile wallets. 10% more people are now using mobile wallets, and of those that added a mobile wallet to their phone during the pandemic, 98% plan to continue using it. When it comes to other cashless payments, more than 55% of Australian adults have used a bank card at unattended parking meters, kiosks, and exit barriers.

When it comes to restaurants, business owners have seen a considerable shift in sales. Australians, reportedly, eat out an average of two to three times a week, which is more than 50 million meals per week. But with the wave of the coronavirus, small businesses must find creative alternatives for business continuity. Through the enablement of cashless payments and reducing the contact during the sales process, solutions like unattended terminals can offer a new stream of sales, and drive new revenue, all while providing a convenient and consumer-friendly service.

What do the Japanese think?

In each country, the adoption and progression into a cashless economy depend heavily on the advances the government makes and the support it provides its business owners. For Japan, 2019 was the year they stepped up their cashless initiative. It started with the enablement of business owners to pay their employees with digital payments via their cell phones. Another advancement was the government’s support in replacing cashiers that formerly only accepted cash by equipping them with cashless payment systems.

According to Nikkei, starting from October, consumers that opt for cashless payments will be offered 2% discounts at Japan’s convenience stores, in an effort to help balance the rise in consumption tax jumping from 8% to 10%. In addition, the government will offer points redeemable for future discounts to shoppers who use QR codes and other cashless payments for a period of nine months, Nikkei reports.

When it comes to credit card firms and other cashless payment operators, often to encourage sales and return customers, points will be awarded to customers upon purchases. Understanding the importance of incentivized purchases and economic growth, Tokyo set aside ¥180 billion in their 2019 fiscal budget for such businesses for the value of these rewarded points, providing small merchants with up to 5% of their overall purchases.

Looking at the number of cashless payments, back in 2017, the total payments in Japan reached 21%. That said, the amount of cashless transactions has continued to climb. Out of the current digital transactions conducted in Japan, credit cards accounted for nearly the entire amount – totaling 90%. Specifically, in Japan, the use of debit cards has had lower adoption rates due to the slow promotion of their usage by domestic banks. Even with their limited usage, debit cards along with credit cards have been widely accepted in all but Japan’s smallest of businesses, through the use of various e-money systems supporting contactless payments in shops or at vending machines. Unattended machines that were equipped for credit/debit card payments were far more likely to see an increase in vending and kiosk sales. For those only accepting cash, it’s simply a wasted opportunity.

The EMarketer reported that in 2019, there were 19.1 million people in Japan making mobile point-of-sale (mPOS) transactions. The public sentiment toward using mobile devices for transactions in place of cashiers in physical stores has reached 38% in 2019, showing an increase of 25% compared to 2018. The use of cash year over year has consistently declined as the use of digital payments of credit/debit cards and mobile apps has increased.

From those that were surveyed, when it came to the preference of using cash for in-store purchases, the amount had dropped by 10%, compared to 2018 respondents. Without a doubt, Japan is well on its way to a cashless future. But like in most countries, the shift in payment behavior will take consumers, business owners, and the government working together to create a fully digital payment process.

How is China advancing?

Moving across the Asian countries, it’s clear that on a global scale China is the leader in the digital payment revolution. In the past decade, China has advanced its payment technology, upgrading to magnetic strip cards and moving the country to a mobile-based system where payments can primarily be conducted through smartphones and QR codes.

A driving force in the shift to digital payments is accredited to the rise of the two major payment platforms: Alipay and WeChat Pay, Brookings Reports. These two cashless payment forms have transformed China into a cashless-driven economy. The Chinese market has been dominated by these two businesses as 90% of residents in China’s largest cities use both Alipay and WeChat Pay as their primary payment method, with cash second, and card-based debit/credit in a distant third, Brookings reports. With payments from mobile app wallets overtaking China, the total amount has reached over $41 trillion (277 trillion yuan) annually.

Countries around the world are advancing toward their governments supporting a cashless future at their own pace. So, what has led China to make such a giant change within its economy? A major contributor that enables countries to adopt cashless behaviors is the government’s support and the importance they place on advancing their systems. Countries like China, that have done so, set the necessary foundation to support a country-wide change. Back in 2017, the Chinese government decided to increase the number of mobile wallet users. To that end, they began requiring customers to keep a minimum of 20% of their funds in a custodial account at a Chinese bank, where consumers wouldn’t be charged interest. This effort helped Chinese citizens move towards a cashless currency.

China doesn’t just look for ways its systems can support digitalized payments. They also continuously look for ways to naturally incorporate cashless behavior into their citizens’ lives. Take the customary money gifts that are given annually throughout the holidays. China launched a campaign to increase cashless payments by offering consumers to gift their loved ones with a cashless alternative. Ideas like these show how the Chinese government is constantly searching for new opportunities where digital payments can provide convenience without disrupting its consumers. China has One example is launching campaigns to replace customary cash gifts with digital payments.

As more technologies emerge, the amount of digital payments increases, providing a variety of ways merchants and businesses can enable cashless payments. Take mobile proximity payments. Often used to boost vending and kiosk sales in the unattended market, consumers can pay using proximity technology (NFC – Near Field Communication). Scanning QR codes is one such example and has gained popularity throughout China due to the low implementation costs. From a report put out by the EMarketer there is a clear increase in adoption just in the past year.

China has made a considerable effort to move its country forward and without a doubt, it’s paid off with its high cashless payment acceptance rates. The use and function of cash continue to be discouraged, and with cashless capabilities continuing to increase across banks, merchants, and governmental services, it won’t be long before a phone will be all anyone will need.

Digital payments in New Zealand

Last, but not least, we’re taking a look at New Zealand. In comparison with the other countries we’ve explored, New Zealand’s citizens show a similar receptivity to the Chinese. Nearly 90% would prefer to handle payments electronically, one study shows. That said, cash usage hasn’t dropped completely, with three-quarters saying they still use of cash once or twice a week. That’s expected since those who were surveyed also admitted to carrying cash or coins around with them.

Helping reduce the use of cash even further, the New Zealand Reserve Bank put out a statement against its use during the lockdown, claiming the lack of hygiene. During that same period, the retail banks increased contactless payment limits from $80 to $200 to reduce the need for PIN pads and avoid the possible spreading of the Coronavirus.

As seen in other countries, one factor that plays heavily in the consumer adoption of cashless behavior is smartphone penetration. In New Zealand, 76% of the population has a smartphone reports JP Morgan, and subsequently, nearly a third of e-commerce sales are driven through mobile devices. With numbers as high as they are, the way is being paved for more consumers to use their devices for food sales and/or when paying for products or services.

Per respondents of a recent survey from Computer World, nearly 23% of smartphone users claim to use their device to pay for products or services, with 62% relying on banking apps for these transfers. Regardless, those that were surveyed also showed 50% that hadn’t yet started using their mobile payments. These numbers showed an opening in the market for business when it comes to developing new technology to increase consumers usage.

Insight from JP Morgan reports sheds light on the growing percentages of young metropolitan consumers, who are far more likely to use smartphones for cashless transactions, like their online shopping, compared to older demographics. For those merchants that offer payment capabilities including scan to play, QR code payment, tap-n-go along with credit/debit cards, they are far more likely to see a boost in their sales from a younger demographic, as 15-24 years old’s spend six hours or more a week online compared to the overall average. When analyzing the payment options the New Zealand public prefers, cards lead in holding the majority at 56% across all transactions. Following behind cards are digital wallets which consumers have quickly adopted, taking a 22% share in e-commerce payments.

Across the world, the shift toward a cashless future is well on its way. The advances in technology and systems that each government takes clearly correlate to how quickly their citizens adopt these new cashless payment habits. But with the growing trends of consumers, providing cashless capabilities is becoming a growing necessity for business owners. The question to add cashless capabilities is not if but, rather, when to make this move. Providing your consumers with digital payment options can give businesses, including the unattended sector a chance to leverage sales and provide new growth opportunities.