What Is Biometric Authentication?

In the fight against fraudulent credit card usage, technology has turned to biometric authentication. Biometric technology has made great strides over the last few years and is already integrated into everyday life, commonly used in smartphone security, workplaces, banking, healthcare, cars, as well as border control, and other official institutions. The most well-known forms are fingerprint scanning, voice and facial recognition, as well as iris scanning, but can also include gait, heartbeat or even how someone types.

Fingerprint Scanning Credit Cards

In a world with increased cybercrime, financial fraud, security breaches, and rising credit card usage, card issuers are looking for more secure authentication processes. PINs and passwords are static forms of information and can too easily be stolen or forgotten. Enter the contactless biometric credit card.

A biometric credit card is a combination of fingerprint scanner and EMV card technology. Initially, the card owner will be required to go to their bank to register their fingerprint. Then, when paying, you place your finger over a small scanner embedded in the card and the card draws power from the card reader to activate the fingerprint reader. This then calculates if there is a match with the rightful owner’s fingerprint/s, and the payment will be authorized.

What Are the Advantages of Biometric Payment Cards?

1. Better Protection of Your Data

Unlike PINs, fingerprint data is encrypted and is only stored in the card, bypassing the need for a central database connected to the internet, protecting a card user’s sensitive data from hackers. Additionally the technology safeguards against duplicated 2D and rubber fingerprints because it requires electrical capacitive sensing.

2. Even More Convenience

Credit cards save consumers time and allow them to pay quickly. For EMV PIN and chip cards, remembering a PIN code can slow down the process. Using fingerprint authentication can speed the process along and reduces friction in the payment process.

Ask us about our EMV payment acceptance

3. Works with Existing POS Infrastructure

A biometric credit card will work on any EMV ready payment terminal and no modification is required for existing Point of Sale devices. This means there are no rollout costs for the merchants and this technology can become accepted quickly.

What Are the Challenges?

Despite the biometric payment card containing strong security elements, there are roadblocks to it becoming mainstream. The first obstacle is cost. The price point is above $20, significantly more than the $1-2 EMV cards, which banks have already invested in.

Secondly, the biometric credit card faces competition from mobile phone payment and wearables, which offers equally strong protection with tokenization. Additionally, there are some energy harvesting issues and lack of universal procedures that both hinder the cards from becoming mainstream.

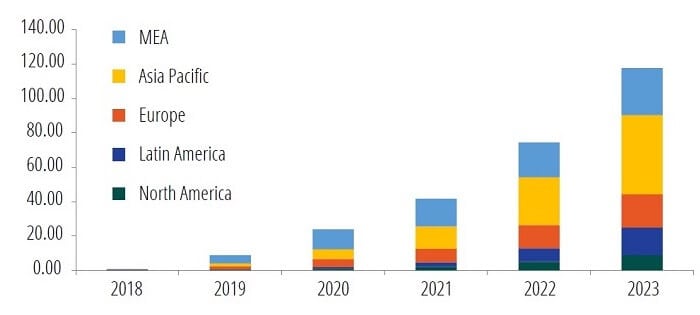

Biometric Credit Card Rollouts

Both Visa and MasterCard have been developing these cards, with trials taking place in several locations. Regardless of the number of cards that get deployed, biometric credit cards join the many cashless payment options available to consumers. These innovations only add to the conversation regarding payment security and bolster fintech development.