A payment system is a set of processes, technologies, and rules that facilitate the transfer of monetary value between parties. These systems enable businesses, consumers, and financial institutions to conduct transactions efficiently and securely.

Components and Mechanisms

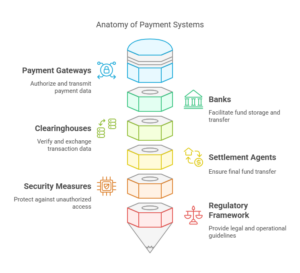

Payment systems comprise various components and mechanisms that work together to process transactions. Key components include payment gateways, banks, clearinghouses, and settlement agents. Payment gateways serve as intermediaries that authorize and transmit payment information from the customer to the merchant’s bank. Clearinghouses facilitate the exchange and verification of transaction data, while settlement agents ensure the final transfer of funds between financial institutions. These interconnected elements ensure that payments are processed accurately and promptly, reducing the risk of errors and fraud.

Types of Payment Systems

There are several types of payment systems designed to meet different transaction needs. Real-Time Gross Settlement (RTGS) systems process high-value and urgent transactions individually, ensuring immediate settlement. Automated Clearing House (ACH) systems handle batch processing of smaller, non-urgent transactions, typically used for payroll, direct deposits, and recurring bill payments. Card networks, such as Visa and MasterCard, enable credit and debit card transactions at points of sale and online. Additionally, emerging digital payment systems, including mobile wallets and cryptocurrency platforms, offer innovative ways to conduct transactions using modern technologies.

Security and Regulation

Security and regulation are critical aspects of payment systems, ensuring the integrity and trustworthiness of transactions. Payment systems employ advanced security measures such as encryption, tokenization, and multi-factor authentication to protect sensitive information and prevent unauthorized access. Regulatory bodies, such as central banks and financial authorities, establish guidelines and standards to govern the operation of payment systems, ensuring they operate within a legal framework and maintain financial stability. Compliance with these regulations helps mitigate risks and fosters confidence among users.

In summary, payment systems are essential infrastructures that enable the smooth and secure transfer of funds between parties, supported by a network of components, various transaction types, and stringent security and regulatory measures.